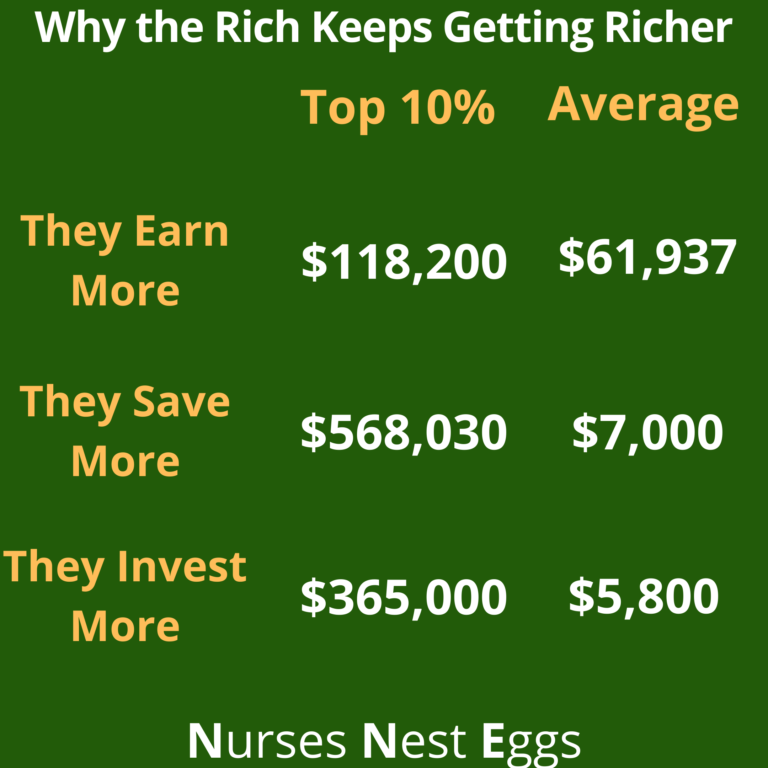

Even during the coronavirus lock down and economic crisis as a result of this, the rich keeps getting richer. The top 1% saw a 157.8% increase in their wage since 1979 while the bottom 90%’s wage went up by 24%. Furthermore, the top 0.1% saw a 340% increase in their income. Why the rich keeps getting richer is because they earn, save, and invest more. They also earn a higher return than the average.

The Rich Earn More

It makes sense assuming that doctors and lawyers earn more income than fast food workers and waiters/waitresses. According to U.S. News, the top paying occupation was an anesthesiologist with a median salary of $208,000. A nurse anesthetist was 10th on the list with a median income of $174,790.

Does this mean that an average workers can’t earn more? I don’t want to say that you have to work harder because that assumes that anesthesiologists and surgeons didn’t work hard to get there. Rather, I think you have to do a little more than you are currently doing in order to get ahead. You may have to take on extra work, get promoted, get an advance degree for a higher paying job, or start a side hustle.

Lesson: Ask yourself how can I earn more income?

The Rich Save More

According to CNBC, an average savings for the top 10% net worth is $1057,090 with the median of $568,030. In contrast, the lowest 20% average savings is $24,150 with the median being $2,000. It’s logical to think that you can save more if you can earn more. Instead of saving 10%, strive to save at least 20 of your income. While it may be challenging to save $100,000, it can be the seed money to start a business or a down payment on your first real estate investment.

Save More by Spending Less

While you may not make a six figure income (yet), you do have control on how much you spend. Determining how many hours you have to work before you buy an item may curtail your spending.

Lets’ say you make $60,000 year in salary, and you want to buy the newest model of Louis Vuitton purse for $3,000. If you make $60,000, you make $28.8 per hour ($60,000 divided by 2080 hours). This means you would have to work 104 hours or 2.6 weeks to pay for this purse. Ask yourself, is this worth 2.6 weeks of work?

Lesson: Calculate how many hours you have to work to afford the item. This will quickly help you determine if it is worth it.

The Rich Invest More

The top 10% own approximately 85% of stocks. While an average earner may not have as much to invest as the rich, anyone can buy stocks. You can open a brokerage account instantaneously. It does take a day or two to link your account to a bank and transfer the money. This is an easy and fast process.

Anyone can learn to pick a winning ETFs or stocks. The key is to start.

The Rich Get Higher Returns

In a study that looked at investment returns from 2004 through 2015, 75th percentile had a return of 50% while the top 0.1% had a 140% on the same invested dollar. They risk more and higher risk investments comes with higher return.

The stocks have higher return than bonds. By investing in stocks, the rich make capital work for them. The top 10% net worth is $1,224,000. With an average annual return of 10% on stocks, they would have $1,346,400 after a gain of $122,400 in one year.

This is why the rich keeps getting richer.

Lesson: Ask, “How do I get a higher return on my principle?”

By learning what the rich people do that poor people don’t do, we can learn to be rich too.

Main Take Aways:

- Think about the ways you can earn more income.

- Figure out how you can save more by spending less.

- Invest aggressively and make your money multiply.